Now that we are all clear on Informed Consent, we know that

is a huge part of self-advocacy. It’s also part of obtaining a diagnosis. Or a

few.

However, even armed with knowledge that you have a say in your medical care and what you are willing (or

not willing) to go through, it is only the base you stand on when it comes to

obtaining a proper diagnosis.

As a nurse, I am fortunately (or unfortunately) armed with a

bit more knowledge regarding anatomy, microbiology, pharmacotherapeutics,

procedures, etc. This conveys into a trust with any particular physician. In my

case, it was initially unfounded trust. Hey, it happens.

After I fell, I went to the closest emergency room. After an

x-ray that was “normal”, they referred me to an orthopedist. I had already had

a run in with one of the ‘big’ ortho groups in the area after my daughter

injured her ankle. I also had a run in with a different group after my consent

form for an arthroscopic procedure on my LFET knee was written for my RIGHT. (I

probably should have discussed this in my last post). So, needless to say, I

felt slim on options and I hadn’t necessarily heard anything negative about

this guy. {NOTE: as a nurse, my definition of “negative” about a physician

centers on medical ability more so than bedside manner}

Initially, I didn’t have any trouble with the guy. He

ordered an MRI (totally appropriate). He wanted me off of work until after the

MRI (also appropriate). I worked at a relatively small assisted living facility

at the time. By small, I mean we had a total of 4 nurses…and we were currently

short one. The facility itself was 2 floors with an additional single level in

the back. Overall, it has approximately 150 rooms. I NEEDED to work. My residents

needed a nurse there and there wasn’t enough to go around. With that necessity

discussed, he wrote minor restrictions so I could work (yay for

communication!). I left with an ace wrap, a return to work (with restrictions)

note and crutches as needed. A good initial appointment in my mind.

Due to an insurance snafu at work (more on that in a future

post), I ended up working for a month before the MRI. This equaled about 250

hours on my feet. Yep. 250 hours. I used the crutches to get from one side of

the building to the other. I used some crutch covers I had gotten for my

youngest in 2006 when she broke her leg. Since there was pockets in the covers,

I would put the nurse’s cellphone and any little items I needed to take back

and forth in the pockets. My health care coordinator (assisted living’s version

of a director of nursing aka, my boss) had scheduled an additional medication

tech to assist me to reduce my ‘walking/upright/on my feet’ hours. Some days it

helped and other days it didn’t. I would be barely able to move by the time it

was time to clock out. Once I would get home, my knee was so swollen you could

see imprints from the neoprene sleeve I had on.

Due to an insurance snafu at work (more on that in a future

post), I ended up working for a month before the MRI. This equaled about 250

hours on my feet. Yep. 250 hours. I used the crutches to get from one side of

the building to the other. I used some crutch covers I had gotten for my

youngest in 2006 when she broke her leg. Since there was pockets in the covers,

I would put the nurse’s cellphone and any little items I needed to take back

and forth in the pockets. My health care coordinator (assisted living’s version

of a director of nursing aka, my boss) had scheduled an additional medication

tech to assist me to reduce my ‘walking/upright/on my feet’ hours. Some days it

helped and other days it didn’t. I would be barely able to move by the time it

was time to clock out. Once I would get home, my knee was so swollen you could

see imprints from the neoprene sleeve I had on. |

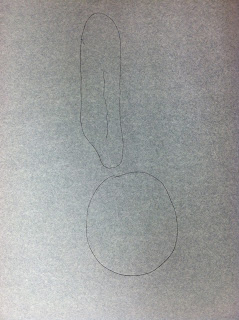

| Orthopedist's drawing of my fracture |

I *thought* it was simply another meniscus tear but it was a fracture of the patella (kneecap). It was what is referred to as a “non-displaced” fracture, meaning while there was a break in the bone, it still stayed together. All that was required was to wear the fancy brace and stay off it.

Except it hurt like hell with the brace on. So I called the

ortho. He had me come in for an adjustment. That lasted until I removed it for

a shower. Once I put it back on, it wasn’t long before the pain increased

again. So I called the ortho. He had me come in for an adjustment. That lasted

until I removed it for a shower. Once I put it back on, it wasn’t long before

the pain increased again. So I called the ortho. At this point the only thing

they could do was put me in a full leg immobilizer. Which would cost more money.

Ugh.

I decided to do the only thing that could be done…I stayed

in bed (except going to the bathroom) with my leg straight without the brace.

If I needed to go to anywhere that was too long to hop to, I put the brace on.

It wasn’t long before I noticed when my right foot slid over

my left ankle, it tingled. Just for a second and it seemed to have to be a

particular area to be touched. But around that time, I also noticed my foot

felt really cold. So I started keeping one of those soft aloe infused spa socks

on it.

Next came the vice around my thigh just above my knee. Now,

by the time this began, I was allowed to walk wearing the brace, I was in

physical therapy and there was even a bend to the knee in the brace. It was a

small bend, but my knee and I both knew it was there.

I had been in the ortho’s office multiple times by this

point, in addition to discussing the issues with my physical therapists. My

ortho seemed unphased at all. Like this was normal. The nurse in me knew it

wasn’t, the patient in me trusted the doctor. I went with the nurse in me and

insisted on another MRI.

Things were about to get interesting.

It all starts with one step.